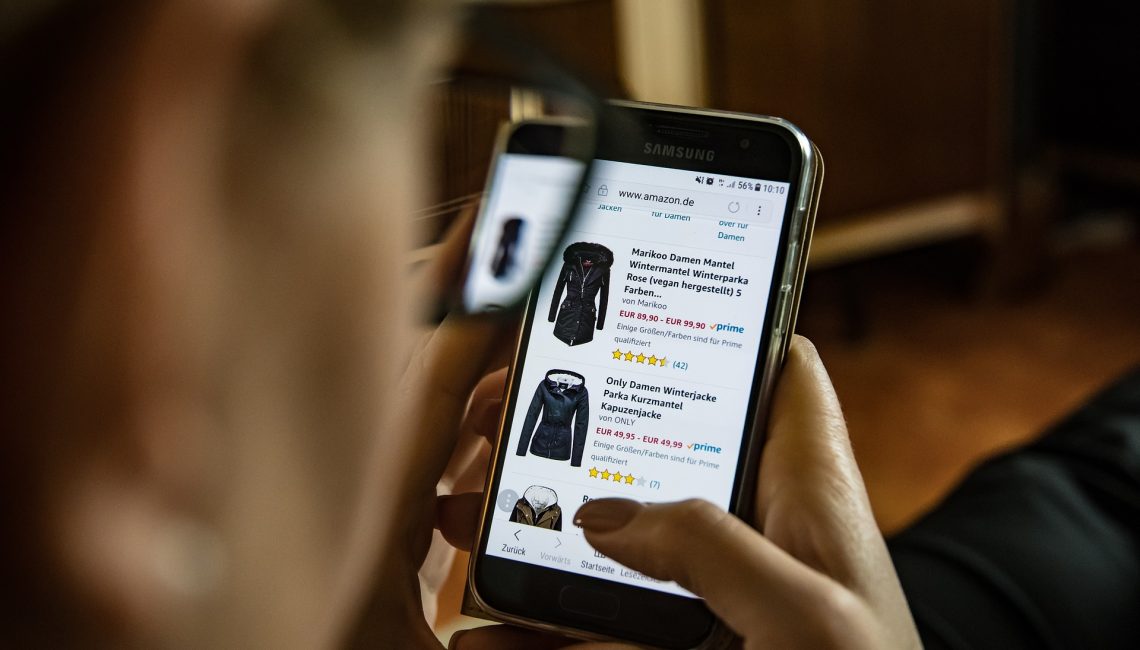

Are you an Amazon seller? Here’s what you need to know about insuring your e-commerce business.

According to Amazon, merchants who are making at least $10,000 a month are required to take out a $1 million insurance policy. But even if you’re new to the platform and waiting on your first sale, you may still want to consider taking out insurance.

Want to learn more about how insurance can help your online business? Read on to find out.

Why Insurance Matters for Amazon Sellers

Expanding your reach on Amazon’s platform does have its perks — after all, who doesn’t want to have more sales, more revenue, and more customers? But along with that uptick in sales volume, there are more opportunities for things to go wrong. By insuring the products you sell to Amazon shoppers, you can protect yourself, your finances, and your business with relative ease.

What Type of Insurance Should You Consider?

In our experience, there are at least three insurance options that Amazon sellers may wish to consider:

1. Product Liability Insurance

If someone is seriously injured or killed while using your product, you could be forced to defend yourself in court. While you can’t predict when a product will malfunction or when those manufacturing defects might cause a serious injury, product liability insurance can cover the cost of injury claims, medical expenses, legal fees, and more.

2. Commercial General Liability Insurance

Most business insurance packages will include some form of commercial insurance. Why? Because it’s versatile enough to handle slip and fall accidents, business interruption, and car accidents involving commercial vehicles. Whether you work in an office, a factory, or everything in between, commercial general liability insurance can give you peace of mind in your day-to-day operations.

3. Umbrella Insurance

When you calculate the cost of medical bills, judgment amounts, and legal fees, $1 million might not be enough to fund a lawsuit from start to finish. Umbrella insurance acts as a top-up fund for the rest of your insurance. Even if you hit the limit of your insurance policy, umbrella insurance makes it possible for you to continue your lawsuit without having to pay for it yourself.

Protect Your Amazon Business With Oracle RMS

When you’re doing business as an Amazon seller, your business faces a number of risks. Here at Oracle RMS, our brokers are invested in your success. We’ll go over your business model and your risk profile before recommending an insurance solution that’s been designed with your needs in mind. Request your FREE commercial insurance quote today.